Best 8 Tips on How to Get Money to Start Forex Trading

Read this “8 Best ways on how to get money to start Forex trading for Profitable Traders” post till the end and choose what is the best way for you on “How to get capital to start trading”.

Making money with Forex trading is not rocket science if you learned the “main FX concept for small Forex traders” correctly. Forex Trading is a huge industry. There are many ways to get Start Forex trading without depositing any money. Some ways have to get more money to increase your trading capital.

Forex trading, also known as foreign exchange trading, is the buying and selling of currencies on the global financial market. This type of trading is popular because it offers traders the opportunity to profit from changes in exchange rates and can be done from anywhere in the world.

In this article, we’ll discuss different ways to get money to start forex trading. We’ll cover options like self-financing, loans and credit, forex broker promotions, forex trading contests, and even outside investment from angel investors and venture capitalists. We’ll also provide tips for effective budgeting and saving, as well as advice for finding the best promotions and contests.

Whether you’re a beginner or an experienced trader, there’s something for everyone in this article. By the end, you’ll have a better understanding of the various ways to fund your forex trading account and be ready to start trading with confidence.

Related: Is Forex Just Guessing?

If you are searching for “Ways to get money to start Forex trading” or Start Forex trading with less money, then this post will be significant for you. We are going to expand many ways to “get capital to start Forex trading” here.

Related: 15 Realistic Ways To Make Money With Forex Website

Some of these techniques can beginner used to get started in Forex trading with no or less money. But, This post mainly writes for Expert traders how have already can make consistent profits in Forex trading.

Trade with your own money.

When it comes to funding your forex trading account, self-financing may be the best option for some traders. Self-financing means that you use your own money to fund your trading account, rather than borrowing money from a lender or seeking outside investment.

There are several ways to save money for trading, and the first step is to create a budget. A budget can help you identify areas where you can cut back on expenses and find ways to increase your income. To create a budget, start by tracking your expenses for a month or two, and then categorize your expenses into different areas such as housing, food, transportation, and entertainment. This will give you a better idea of where your money is going and where you can cut back.

Reducing expenses is another important aspect of effective budgeting. Consider ways to cut back on unnecessary expenses, such as eating out less, shopping for deals, and using coupons or discount codes when making purchases. You can also save money on bills by negotiating with service providers or switching to cheaper alternatives.

Increasing your income is also a key part of self-financing. Consider taking on a side job, selling unwanted items, or starting a small business to generate extra income. You can also explore options like freelancing or online work, which can be done from anywhere and offer flexible schedules.

Finally, it’s important to set realistic goals and timelines for your budgeting and saving efforts. This will help you stay motivated and track your progress over time. Consider setting aside a portion of your income each month specifically for trading, and avoid dipping into these funds for other expenses.

In summary, self-financing can be an effective way to fund your forex trading account. By creating a budget, reducing expenses, and increasing income, you can save money over time and achieve your trading goals. Remember to set realistic goals and stay committed to your budgeting and saving efforts, and you’ll be on your way to trading success.

Visit the Service section at the top of the menu to Get the Best Forex Trading Related Services by FuelForex

FTMO Prop Firm Challenge Passing Service

TFT Knight Challenge Pass Service

Instant Funding Prop firm Management Service

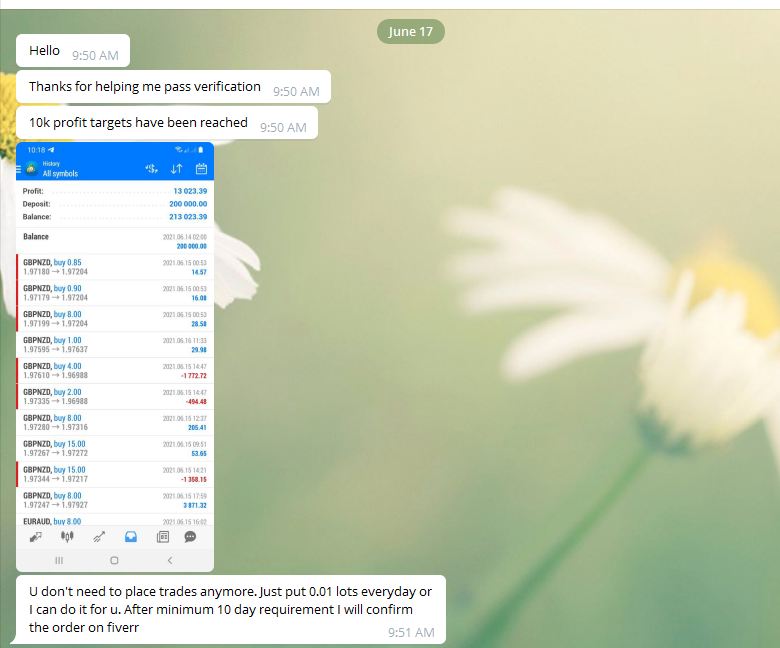

Attract clients with performance.

If you are a good trader, you can attract clients to increase your investment to make a big profit from Forex trading. You can track your Forex trading meta trader account with sites like Forex Factory or My FX Book. Then you can share your performance links directly on social media or through lounging a website.

Find Forex trading Capital using Loans and Credit.

Another option for funding your forex trading account is to take out a loan or use credit. This can be a good option for traders who don’t have the funds to self-finance, but it’s important to understand the pros and cons before making a decision.

One advantage of using loans or credit is that it can provide access to a larger amount of capital than self-financing. This can allow traders to take advantage of more opportunities in the forex market and potentially earn larger profits. However, it’s important to consider the costs of borrowing, including interest rates, fees, and repayment terms.

When considering taking out a loan for trading, it’s important to assess your ability to repay the loan in a timely manner. Late payments or defaulting on the loan can result in damage to your credit score and financial difficulties down the line. It’s also important to consider the potential risks involved in forex trading, as there is always a risk of losing money.

If you decide to pursue a loan or credit to fund your forex trading account, there are a few tips to keep in mind. First, it’s important to shop around and compare rates and terms from different lenders or credit card companies. Look for favorable interest rates, low fees, and flexible repayment terms. It’s also important to maintain a good credit score, as this can help you qualify for better loans or credit terms.

To improve your chances of getting approved for a loan or credit card, consider taking steps to improve your credit score, such as paying bills on time, reducing credit card balances, and disputing errors on your credit report. You can also consider applying for a secured loan, which is backed by collateral such as a car or house, as these loans may have more favorable terms.

In summary, loans, and credit can be viable options for funding your forex trading account, but it’s important to carefully consider the costs and risks before making a decision. Remember to compare rates and terms, maintain good credit, and only borrow what you can afford to repay in a timely manner.

Forex Broker Promotions.

Forex brokers often offer promotions to attract new clients and encourage trading activity. These promotions can provide traders with added benefits and incentives to fund their trading accounts and make trades.

One common type of promotion is a deposit bonus, where the broker offers a percentage of the deposit amount as a bonus. For example, a broker might offer a 50% deposit bonus, which would provide an additional $500 for a $1,000 deposit. Another common promotion is cashback rewards, where traders receive a percentage of their trading volume back as cash. For example, a broker might offer a 5% cashback reward, which would provide $50 for every $1,000 in trading volume.

To find and take advantage of the best promotions, it’s important to research different brokers and compare their offerings. Look for brokers with a good reputation, favorable trading conditions, and a wide range of promotions. Read the terms and conditions of each promotion carefully, and make sure you understand the requirements and restrictions.

When considering a deposit bonus, for example, it’s important to understand the withdrawal requirements. Some brokers may require traders to reach a certain trading volume before they can withdraw the bonus funds, while others may require traders to make a certain number of trades or hold the funds for a certain period of time.

It’s also important to consider the overall trading conditions and services offered by the broker, rather than just focusing on promotions. Look for brokers with competitive spreads, low fees, and reliable customer support. Consider factors such as trading platforms, educational resources, and market analysis tools, which can be valuable for traders of all levels.

In summary, forex broker promotions can provide traders with added benefits and incentives for funding their trading accounts and making trades. To find and take advantage of the best promotions, research different brokers, read the terms and conditions carefully, and consider overall trading conditions and services.

No Deposit Bonus.

Some Forex brokers do offer no-deposit bonuses to attract new clients. If you search for “start Forex trading without deposit”, or “Forex no deposit bonus” in your search engine or google, You will be able to find these places easy to get Free money to Start Forex Trading.

Latest Forex No Deposit Bonus Brokers List.

Here are some popular Forex brokers who offer to “start trading with on money”. We do not recommend any of these Forex brokers. That is why we did not mention any links for any site. You can simply copy and paste these names to find your broker to get a No Deposit bonus of Forex Trading.

| Broker Name | Bonus Amount |

|---|---|

| XM | $30 |

| FBS | $140 |

| GANNMarkets | $30 |

| Meefx | $5 |

| EMD Forex | $25 |

| Al-Awal | $50 |

| AXI | $50 |

| FXPrivate | $10 |

| Velocity Trades | $25 |

| FX Open | $10 |

| AEGA | $5 |

| Forex.ee | $15 |

| GICM | $25 |

| Bybit | $10 |

| BITPAX | $15 |

| 7Bforex | $25 |

Deposit Bonus or Tradeable Bonus.

You can find some brokers to get “Tradeable bonuses” to increase your Capital with their “bonus for investment”. Here are some brokers that offer you can get a tradable bonus for your investment.

- IKOFX

- AccentForex

- Corsa Capital

- FxGlory

- HotForex

- FBS

- Capital Street Forex.

Forex Trading Contest.

Forex trading contests are competitions where traders compete against each other to achieve the highest returns on a demo trading account within a specific time frame. These contests are often sponsored by brokers or other companies in the industry and can provide traders with a chance to test their skills and win prizes.

Contests typically involve a set of rules and guidelines, including minimum deposit requirements, maximum trade sizes, and trading periods. Traders are usually required to sign up for the contest and create a demo trading account, which is used to track their performance and results. The trader with the highest returns at the end of the contest period is declared the winner and may receive a prize, such as cash, trading credits, or other rewards.

Participating in a forex trading contest can offer a range of benefits, such as the opportunity to test trading strategies, gain experience in a competitive environment, and win prizes. However, there are also some potential downsides to consider, such as the risk of overtrading or taking on too much risk in an attempt to win.

When looking for a forex trading contest to participate in, it’s important to research and choose reputable contests. Look for contests sponsored by well-known brokers or industry organizations, and read the rules and requirements carefully. Consider the types of prizes offered and the trading conditions, such as the maximum leverage and trade sizes.

It’s also important to have a solid trading strategy and risk management plan in place before entering a trading contest. Don’t take on too much risk or deviate from your trading plan in an attempt to win the contest, as this could result in significant losses.

In summary, forex trading contests can provide traders with a chance to test their skills and win prizes, but it’s important to choose reputable contests and have a solid trading strategy and risk management plan in place.

Related: Find Best Forex Broker According To Trading Style

Demo Trading Forex Contest

Brokers like “Grand Capital, RoboForex, LiteForex, LAND-FX, InstaForex, and Investing” offer Demo trading Contests. you can participate in that contest without paying any dollar to get money to trade. You can read their conditions to get more info.

- Grand Capital

- RoboForex

- Investing

- InstaForex

- FXOpen

Forex Trading Live Contest.

You can participate in Live contests of the Forex account to achieve the targets and get more money to increase your balance of the Trading account.

- Tickmill

- ForexChief

- AMEGA FX

- Traders Trust

Start a Forex Trading Signal Service.

If you are a consistently profitable trader, then you can start a Forex trading signal service to grow your trading income in another way. You can use your profit from the signal service to increase your account balance.

Be a Personal Fund Manager.

By Starting a Personal Fund Management Service you can get more money to start Forex trading. You can use YouTube, Freelancing sites, and Social media sites to get more clients.

You can get our personal fund management service if you have money to invest in Forex Trading.

Get Forex Money from Angel Investors and Venture.

Angel investors and venture capitalists are individuals or companies that provide funding to startup businesses or entrepreneurs in exchange for equity in the company. They can provide a source of capital for forex traders who are looking to start trading but may not have the necessary funds available.

Angel investors are typically high-net-worth individuals who invest in businesses in the early stages of development. They may provide funding in exchange for equity in the company or convertible debt, which can be converted into equity at a later stage. Venture capitalists, on the other hand, are institutional investors who typically provide larger sums of money to startups that show high growth potential.

Seeking outside investment can have a number of potential benefits for forex traders. It can provide access to capital that may not otherwise be available and can also bring in outside expertise and industry connections. However, there are also some potential downsides to consider, such as the loss of control over the business and the dilution of equity.

When looking for potential investors, it’s important to research and identify individuals or companies that have experience or interest in the forex industry. Attend industry events and networking opportunities to meet potential investors and build relationships. When pitching to investors, be prepared to provide a comprehensive business plan and financial projections that outline the potential return on investment.

It’s also important to consider the terms of the investment carefully, including the equity or ownership stake that will be given up in exchange for funding, and any potential restrictions on how the funds can be used. Seek the advice of a legal or financial professional to ensure that the terms of the investment are fair and equitable.

In summary, angel investors and venture capitalists can provide a source of capital for forex traders, but it’s important to carefully consider the potential benefits and drawbacks before seeking outside investment. Research potential investors carefully and be prepared to provide a comprehensive business plan and financial projections when pitching for funding.

Prop firm Trading Funds Management.

Prop firms are another perfect way to increase your trading capital. Many Prop firms do offer different types of conditions for their clients. Here are a few prop firm trading sites those you can get a big forex trading account if you agree with their trading conditions.

We offer Prop Firm trading services on our website and social media. You can contact us to get more info.

Related: Ways to Learn Forex Trading

Conclusion of ways how to get money to start Forex trading.

We have many ways to increase currency exchange trading funds fast. But, traders must care about the pros and cons of the ways they choose for it.

Making money with Forex Trading is not too hard. But everyone has to work hard to understand the basic concept. If you follow these methods in the right way, you can increase currency exchange trading funds fast.

Related Articles:

FTMO passing service and management

The Best Way How To Start Day Trading In Forex For Beginners

Best Ways To Make Money With Forex Website

What Should Learn to Start Forex Trading?

What Are Ways To Learn Forex Trading?

How To Become A Successful Forex Trader

Forex Trading Strategy: Best Tips To Make Own

10 Forex Trading Strategies: Best For Beginners

Why Do Most Forex Traders Lose Money?

The Dark Secret Of Forex Trading

Important Things To Consider Joining A Forex Prop Firm

Best And Complete Learn Forex Trading For Beginners

Best Secret Forex Scalping Techniques With 3 Strategies.

Quickest Tips To Build Own Forex Trading Strategy

Fundamental Analysis Resources To Learn Trading

Amazing Guide On Four Types Of Traders In Forex

Most Popular General Facts Of Forex Trading

The Psychology Of Successful Forex Traders

How To Schedule A Trade On Forex | 5 Planning Checklist

The Ultimate Introduction To Forex Trading

Way To Open Live Forex Account ECN Broker