9 Top Forex Prop Firms to Kickstart Your Trading Career.

What Our Clients Said About Our Prop Firm Passing Service

Amazing results. Passed the evolution process within 20 days.

Martin Foster

I Highly recommend any prop firm passing service.

Bryan Cirius

Fuel forex is always best. this is my 3rd account.

Jane Dowser

Are you an aspiring trader looking to kickstart your career in the forex market? One way to do that is by joining Top Forex Prop Firms, commonly known as a Forex proprietary trading firm. These firms offer an opportunity to trade with their capital and share profits with successful traders. However, choosing the right prop firm can be overwhelming, given the numerous options available. In this article, we have compiled a list of the top forex prop firms to help you make an informed decision.

Forex prop firms, or proprietary trading firms, are companies that provide traders with the capital and resources to trade the financial markets. Traders are typically hired on a freelance basis, and they are given a certain amount of capital to trade with. The profits earned are shared between the trader and the prop firm, and the trader is able to keep a percentage of the profits.

In this blog post, we will be discussing the top Forex prop firms in the industry. These firms have been selected based on their reputation, trading programs, funding process, and overall performance. The top Forex prop firms covered in this blog post are TopstepFX, The5%ers, FTMO, City Traders Imperium, AudaCity Capital, Maverick Trading, T3 Trading Group, SMB Capital, Bright Trading, and My Forex Funds.

Table of Contents

Visit the Service section at the top of the menu to Get the Best Forex Trading Related Services by FuelForex

FTMO Prop Firm Challenge Passing Service

TFT Knight Challenge Pass Service

Instant Funding Prop firm Management Service

1: TopstepFX

TopstepFX is a Forex prop firm that offers traders the opportunity to trade with a funded account. The company was founded in 2012 and has since then provided traders with a way to access the Forex market without risking their own capital. TopstepFX is a subsidiary of TopstepTrader, which also offers trading programs for futures and equities.

Features and Benefits of TopstepFX

TopstepFX’s main feature is its trading evaluation process. Traders are required to pass a two-step evaluation process in order to qualify for a funded account. The first step is the Trading Combine, which is a simulated trading evaluation designed to test the trader’s ability to manage risk and follow trading rules. The second step is the Funded Account, which is a live trading account with a risk limit.

Another benefit of TopstepFX is its risk management features. The company provides traders with risk management tools, such as a daily loss limit and a trailing maximum drawdown. Traders are also able to keep a percentage of the profits they earn, which can range from 50% to 80%.

Strengths and Weaknesses of TopstepFX [Pros and Cons]

One of the strengths of TopstepFX is its comprehensive trading evaluation process. Traders are required to demonstrate their trading skills and risk management abilities before being given a funded account. This helps to ensure that only skilled traders are trading with TopstepFX’s capital.

However, one of the weaknesses of TopstepFX is its funding process. Traders are required to pay a subscription fee to access the Trading Combine, which can be a barrier to entry for some traders. Additionally, the risk limits on the funded accounts can be restrictive for some traders.

TopstepFX Review and Funding Process

TopstepFX has received positive reviews from traders who have used their trading programs. The company’s trading evaluation process has been praised for its comprehensiveness and effectiveness in identifying skilled traders. However, some traders have noted that the risk limits on the funded accounts can be restrictive.

The funding process for TopstepFX involves a subscription fee to access the Trading Combine. Traders can choose from two subscription options: a monthly subscription or a six-month subscription. Once a trader has passed the Trading Combine, they are given a funded account with a risk limit. Traders are able to earn a percentage of the profits they make, depending on the account type they have.

In conclusion, TopstepFX offers a comprehensive trading evaluation process and risk management tools for traders who are looking to trade with a funded account. While the subscription fee for the Trading Combine and the risk limits on the funded accounts can be a drawback, TopstepFX remains a popular choice for Forex prop traders.

2: The5%ers

The5%ers is a Forex prop firm that provides traders with the opportunity to trade with a funded account. The company was founded in 2016 and has since then established a reputation for offering traders a unique and effective trading evaluation program.

Features and Benefits of The5%ers

The5%ers’ main feature is its evaluation program, which is designed to test traders’ trading skills and risk management abilities. The program consists of multiple stages, each of which has its own set of requirements and objectives. Traders are required to demonstrate their trading skills and risk management abilities at each stage in order to progress to the next stage.

One of the benefits of The5%ers is that it provides traders with a fully-funded account. Traders who successfully pass the evaluation program are given a funded account with a risk limit. Traders are able to keep a percentage of the profits they make, which can range from 50% to 90%.

Strengths and Weaknesses of The5%ers

One of the strengths of The5%ers is its evaluation program. The program is designed to be challenging and comprehensive and is effective in identifying skilled traders. Traders who successfully pass the evaluation program are given a fully-funded account, which can be a significant benefit for traders who are looking to trade with a larger amount of capital.

However, one of the weaknesses of The5%ers is its evaluation program structure. The program is designed to be challenging, which can be a drawback for some traders who may struggle to progress through the stages. Additionally, some traders have noted that the risk limits on the funded accounts can be restrictive.

The5%ers Review and Evaluation Program

The5%ers has received positive reviews from traders who have used their trading evaluation program. The program has been praised for its comprehensiveness and effectiveness in identifying skilled traders. However, some traders have noted that the program can be challenging and may require a significant amount of time and effort to complete.

The evaluation program for The5%ers consists of multiple stages, each of which has its own set of requirements and objectives. Traders are required to demonstrate their trading skills and risk management abilities at each stage in order to progress to the next stage. Traders who successfully pass the evaluation program are given a fully-funded account with a risk limit. Traders are able to earn a percentage of the profits they make, depending on the account type they have.

Conclusion of The5%ers Prop Firm

In conclusion, The5%ers offers traders a comprehensive trading evaluation program and a fully-funded account. While the program structure can be challenging for some traders, The5%ers remains a popular choice for Forex prop traders who are looking to trade with a larger amount of capital.

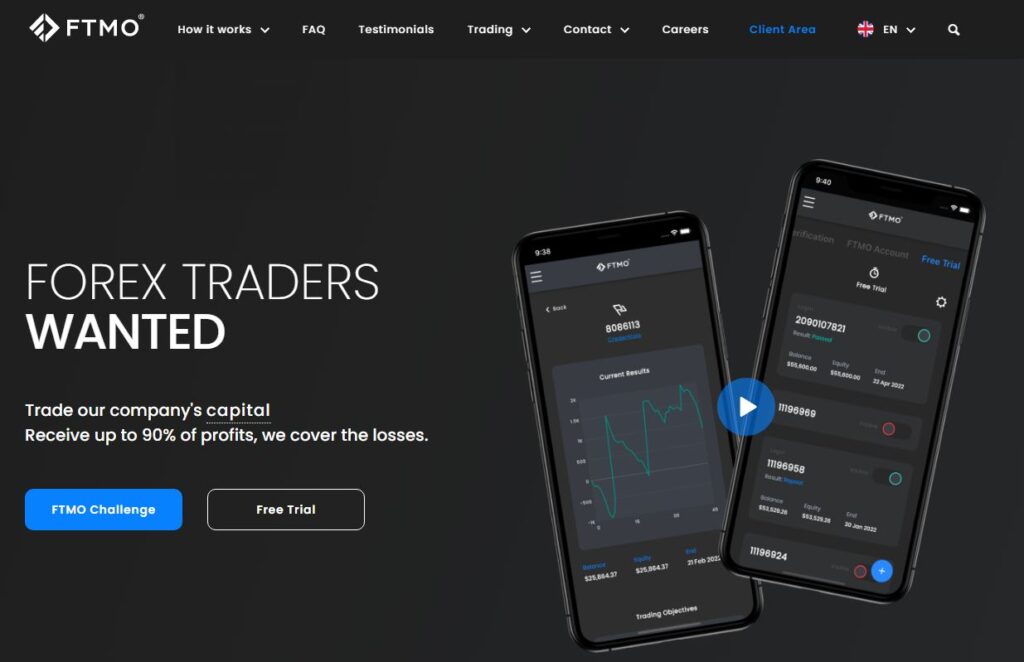

3: FTMO

FTMO is a Forex prop firm that aims to provide traders with an opportunity to trade with a funded account. The firm’s mission is to help traders to achieve their goals by providing them with a platform to showcase their skills and talent. FTMO is one of the leading prop firms in the market, and it is known for its unique evaluation and funding process.

Features and Benefits of FTMO

FTMO offers various features and benefits to traders, including:

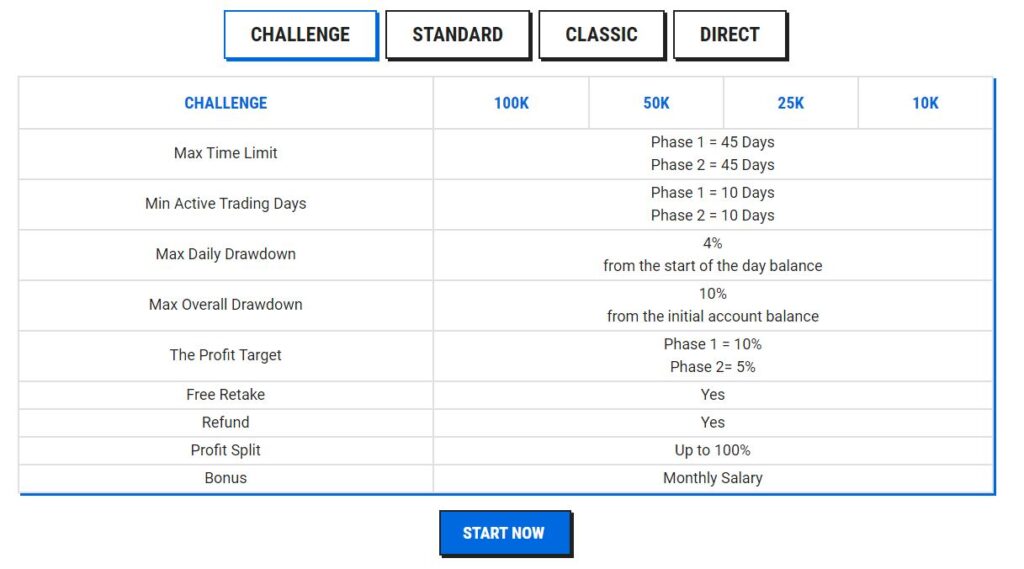

- Unique Evaluation Process: FTMO has a unique three-step evaluation process that ensures only the best traders get funded. The process includes a challenge, verification, and evaluation phase. The challenge phase consists of two parts, and traders need to meet specific targets to progress to the next phase.

- Multiple Account Sizes: FTMO offers traders the flexibility to choose from various account sizes based on their trading style and risk management. The account sizes range from $10,000 to $300,000.

- Fair Profit Split: FTMO has a fair profit split of 70:30 in favor of traders. This means traders get to keep 70% of their profits, and FTMO takes a 30% commission.

- Risk Management Tools: FTMO provides traders with various risk management tools, including a maximum drawdown limit, position size calculator, and risk management plan template.

Strengths and Weaknesses of FTMO

Strengths:

- Unique Evaluation Process: FTMO has a unique evaluation process that sets it apart from other prop firms. The process ensures that only the best traders get funded, and it also helps traders to improve their skills.

- Multiple Account Sizes: FTMO offers traders the flexibility to choose from various account sizes based on their trading style and risk management.

- Fair Profit Split: FTMO has a fair profit split of 70:30 in favor of traders. This means traders get to keep the majority of their profits.

Weaknesses:

- High Fees: FTMO charges a high fee for its evaluation and funding process. The fees can be a barrier for traders who are just starting.

- Strict Rules: FTMO has strict rules and guidelines that traders need to follow. Traders who violate these rules can face penalties or even lose their accounts.

Prop Firm Passing Service

Join us to pass the Evolution Process of the Ftmo Prop Trading Firm.

FTMO Review and Funding Process

Traders who are interested in joining FTMO can visit the firm’s website to learn more about the evaluation and funding process. The evaluation process consists of a challenge, verification, and evaluation phase. Traders need to meet specific targets and rules to progress to the next phase.

During the challenge phase, traders need to trade a demo account with specific rules and targets. If they meet the targets, they can move to the verification phase, where they need to trade a real account with the same rules and targets.

If traders pass the verification phase, they will be eligible for funding. Traders can choose from various account sizes, and they need to pay a fee for the evaluation and funding process.

Conclusion of FTMO Prop Firm

FTMO is a leading Forex prop firm that offers traders a unique evaluation and funding process. The firm’s unique evaluation process ensures that only the best traders get funded, and it also helps traders to improve their skills. Although FTMO has high fees and strict rules, its benefits outweigh its drawbacks, making it an excellent choice for traders looking for a prop firm.

City Traders Imperium Review.

This is an honest review of City Trader Imperium prop firm.

Overview of City Traders Imperium

City Traders Imperium (CTI) is a UK-based Forex prop firm that provides traders with the opportunity to trade with the firm’s capital. The company was established in 2017 and has quickly gained a reputation for its innovative approach to Forex trading. CTI aims to provide traders with a comprehensive range of resources and tools to help them become successful traders.

Features and Benefits of City Traders Imperium

CTI offers a range of features and benefits to traders, including:

Evaluation Program: CTI provides an evaluation program for traders to prove their trading skills and to be funded with a live trading account. The evaluation program is designed to help traders develop their skills and improve their performance before trading with live capital.

Flexible Funding: CTI offers flexible funding options, including a monthly subscription plan and one-time payments. Traders can choose the funding option that best suits their needs.

Profit Sharing: CTI has a profit-sharing model where traders can keep up to 70% of their profits. This model incentivizes traders to trade profitably and helps traders to earn more money.

Access to Tools and Resources: CTI provides traders with access to a range of trading tools and resources, including educational materials, trading software, and market analysis.

Strengths and Weaknesses of City Traders Imperium [Pros and Cons]

Strengths:

- Comprehensive Evaluation Program: CTI’s evaluation program provides traders with a comprehensive assessment of their trading skills and allows them to prove their skills to be funded with a live trading account.

- Flexible Funding Options: CTI offers flexible funding options that allow traders to choose the funding option that best suits their needs.

- Profit Sharing Model: CTI’s profit-sharing model incentivizes traders to trade profitably and helps traders to earn more money.

Weaknesses:

- Relatively New Firm: CTI was established in 2017 and is a relatively new firm compared to some of its competitors.

- Limited Information Available: There is limited information available about CTI’s trading conditions, including spreads, leverage, and fees.

City Traders Imperium Review

Overall, City Traders Imperium provides traders with a comprehensive range of resources and tools to help them become successful traders. CTI’s evaluation program is a standout feature, providing traders with a comprehensive assessment of their trading skills and allowing them to prove their skills to be funded with a live trading account. However, the firm is relatively new, and there is limited information available about its trading conditions. Traders who are interested in joining CTI should conduct thorough research and consider all available options before making a decision.

Funding Process at City Traders Imperium

To become a funded trader with CTI, traders need to pass an evaluation program, which has two stages. The first stage involves trading a demo account, and the second stage involves trading a live account. If a trader passes both stages, they will be funded with a live trading account. The evaluation program is designed to help traders develop their skills and improve their performance before trading with live capital.

Similar Competitor Sites to City Traders Imperium

Similar Forex prop firms to City Traders Imperium include:

- FTMO (ftmo.com)

- TopstepFX (topstepfx.com)

- The5%ers (the5ers.com)

These firms offer similar services and benefits to City Traders Imperium and are popular choices among Forex traders.

AudaCity Capital

AudaCity Capital is a Forex proprietary trading firm that provides traders with the opportunity to access its trading capital. The firm is based in London and has been operating since 2015. It offers a range of trading programs that cater to both beginner and experienced traders.

Features and Benefits of AudaCity Capital

AudaCity Capital’s trading programs come with a range of features and benefits, including:

- Evaluation Program: AudaCity Capital offers a comprehensive evaluation program that allows traders to demonstrate their skills and access the firm’s trading capital.

- Multiple Trading Platforms: The firm supports multiple trading platforms, including MT4, MT5, and cTrader.

- High Leverage: AudaCity Capital provides traders with high leverage of up to 1:400, allowing them to increase their potential profits.

- Competitive Fees: The firm charges low fees, and there are no hidden costs associated with its trading programs.

Strengths and Weaknesses of AudaCity Capital

Strengths:

- The firm provides traders with access to a range of trading programs that cater to different trading styles and skill levels.

- AudaCity Capital offers competitive fees and provides traders with high leverage, allowing them to maximize their potential profits.

- The firm has a transparent evaluation process, making it easy for traders to access its trading capital.

Weaknesses:

- The evaluation program can be challenging for beginner traders, as it requires a certain level of trading experience.

- AudaCity Capital’s trading programs are only available to traders who can pass the firm’s evaluation process.

AudaCity Capital Review

According to various online reviews, AudaCity Capital is a reputable Forex proprietary trading firm that provides traders with access to its trading capital. The firm’s evaluation process is transparent, and its trading programs come with competitive fees and high leverage.

AudaCity Capital Evaluation Program

AudaCity Capital’s evaluation program is designed to assess traders’ trading skills and provide them with access to the firm’s trading capital. The program consists of three stages, and traders must pass each stage to progress to the next level. The evaluation program requires traders to demonstrate their ability to manage risk, follow trading rules, and generate consistent profits.

Conclusion of the AudaCity Capital Prop Firm Review

AudaCity Capital is a Forex proprietary trading firm that provides traders with access to its trading capital. The firm offers a range of trading programs that cater to both beginner and experienced traders, and its evaluation program is transparent and comprehensive. While the evaluation program can be challenging for beginner traders, AudaCity Capital provides traders with high leverage and competitive fees, making it a reputable option for traders looking to access “Forex proprietary trading” capital.

SMB Capital

SMB Capital is a proprietary trading firm that specializes in day trading equities, options, and futures. Founded in 2005 by Mike Bellafiore and Steven Spencer, the company has grown to become one of the most well-respected firms in the trading industry. SMB Capital offers a variety of trading programs for both experienced traders and those new to the field.

Features and Benefits of SMB Capital

One of the main benefits of trading with SMB Capital is access to their trading tools and technology. They provide their traders with a variety of platforms to choose from, including DAS Trader and Sterling Trader Pro. In addition, SMB Capital offers daily educational resources and live mentoring to help traders improve their skills and strategies.

Another feature of SMB Capital is their unique trading program, which allows traders to start with a small account and work their way up to a larger one. This program is designed to help traders learn to manage risk and build their skills gradually, without the pressure of starting with a large account from the beginning.

Strengths and Weaknesses of SMB Capital

One of the strengths of SMB Capital is their focus on education and mentorship. Their team of experienced traders and educators provides ongoing support to help traders improve their performance and reach their goals. Additionally, their trading program allows for a gradual and low-risk approach to building a trading career.

However, one potential weakness of SMB Capital is that they primarily focus on day trading, which can be a challenging and high-pressure trading style for some traders. Additionally, their trading programs can be expensive, which may make them less accessible to newer traders who are just starting out.

SMB Capital Review

Overall, SMB Capital has a strong reputation in the trading industry and is well-regarded for their educational resources and unique trading program. Traders looking for a supportive and educational trading community may find SMB Capital to be a good fit for their needs. However, it is important to carefully consider the costs and potential challenges associated with day trading before making a decision to join SMB Capital or any proprietary trading firm.

Bright Trading

Bright Trading is a proprietary trading firm that has been in operation for over 25 years. It provides traders with access to various markets, including equities, options, futures, and forex. In this section, we will provide an overview of Bright Trading, including its history and how it works.

Overview of Bright Trading

Bright Trading was founded in 1992 by Mark F. Wolfinger, a former floor trader at the Chicago Board Options Exchange. The firm is based in Las Vegas, Nevada, and has branch offices across the United States. Bright Trading provides traders with capital, training, and support to trade various markets.

Bright Trading’s Funding Process: To become a trader with Bright Trading, applicants must go through a rigorous evaluation process. The firm evaluates the trader’s trading strategy, risk management, and trading performance. Successful traders receive funding from Bright Trading, which can range from $25,000 to $500,000. The firm provides traders with a high percentage of profits, typically between 50% to 90%.

Bright Trading’s Features and Benefits

Bright Trading provides traders with various features and benefits, including:

- Access to Multiple Markets: Traders can trade equities, options, futures, and forex markets with Bright Trading.

- High Leverage: Traders receive high leverage on their trades, which allows them to maximize their profits.

- Professional Trading Software: Bright Trading provides traders with professional trading software that includes real-time data and charting tools.

- Risk Management: The firm provides traders with risk management tools and support to help them manage their trading risks.

- Trading Education: Bright Trading provides traders with access to trading education resources, including webinars, seminars, and mentorship programs.

Strengths of Bright Trading:

- Longevity: Bright Trading has been in operation for over 25 years, which demonstrates its stability and reliability.

- Multiple Markets: Traders can trade multiple markets with Bright Trading, which provides them with more trading opportunities.

- High Leverage: The firm provides traders with high leverage, which can increase their profits.

- Trading Education: Bright Trading provides traders with access to trading education resources, which can help them improve their trading skills.

Weaknesses of Bright Trading:

- Evaluation Process: The evaluation process to become a trader with Bright Trading is rigorous and may be challenging for some traders.

- Limited Funding: The funding provided by Bright Trading may be limited, which can be a disadvantage for traders who require larger amounts of capital.

Conclusion: Bright Trading is a well-established proprietary trading firm that provides traders with access to multiple markets and high leverage. The firm’s evaluation process is rigorous, but successful traders can receive significant funding and support. The firm’s trading education resources can also help traders improve their trading skills. Overall, Bright Trading is a reputable firm that may be suitable for traders looking to trade multiple markets with high leverage.

Maverick Trading

Maverick Trading is a proprietary trading firm that provides a unique opportunity for traders to work remotely and trade with the firm’s capital. The firm was founded in 1997 and has since become a leader in the proprietary trading industry. With an emphasis on technology and risk management, Maverick Trading has developed a strong reputation for providing traders with a supportive environment to succeed in the financial markets.

Features and Benefits of Maverick Trading:

- Funding and Leverage: Maverick Trading offers traders a competitive funding structure with up to $800,000 in buying power. Traders are also provided with 10:1 leverage, which can help increase profits while minimizing risk.

- Remote Work: Maverick Trading allows traders to work remotely from anywhere in the world, providing a flexible and convenient work environment.

- Professional Development: The firm provides traders with access to educational resources and ongoing training to help traders develop their skills and stay up-to-date with market trends.

- Supportive Environment: Maverick Trading’s team of experienced traders and staff provides a supportive environment for traders to collaborate and share ideas.

Strengths of Maverick Trading:

- Competitive Funding: Maverick Trading’s funding structure and leverage offer traders a competitive edge in the market.

- Remote Work: Maverick Trading’s remote work model provides flexibility and convenience for traders.

- Professional Development: The firm’s commitment to ongoing training and development provides traders with the tools and resources needed to succeed in the market.

Weaknesses of Maverick Trading:

- Selective Hiring Process: The firm has a selective hiring process and may not be suitable for all traders.

- Performance Requirements: Traders must meet specific performance requirements to maintain their funding and continue trading with the firm.

Maverick Trading: Funding Process and Reviews

Maverick Trading’s funding process begins with an application and evaluation of the trader’s experience, skills, and performance. Once approved, traders are provided with a demo account to practice their trading strategies before moving on to live trading with the firm’s capital. Traders are also provided with ongoing support and training to help them succeed.

In terms of reviews, Maverick Trading has received positive feedback from traders who appreciate the firm’s supportive environment and commitment to ongoing development. However, some traders have noted that the firm’s selective hiring process and performance requirements can be challenging for some.

Conclusion

Maverick Trading is a reputable and competitive proprietary trading firm that offers traders a unique opportunity to trade with the firm’s capital and work remotely. With a strong emphasis on technology and risk management, the firm provides a supportive environment for traders to develop their skills and succeed in the financial markets. While the firm’s selective hiring process and performance requirements may not be suitable for all traders, those who are accepted can benefit from the firm’s competitive funding structure, remote work environment, and ongoing professional development opportunities.

T3 Trading Group.

Here is a legit review of T3 Trading Group Prop firm.

Overview of T3 Trading Group

T3 Trading Group is a proprietary trading firm that provides individuals with the opportunity to trade with the firm’s capital. T3 Trading Group was founded in 2007 by Scott Redler and Gregg Sciabica, both experienced traders. The firm is headquartered in New York City, but it has offices across the United States and in other countries. T3 Trading Group has become one of the largest and most successful proprietary trading firms in the world, providing traders with cutting-edge technology, a supportive community, and a collaborative trading environment.

Features and Benefits of T3 Trading Group

T3 Trading Group offers a number of features and benefits to traders who are looking for a prop firm to trade with. These include:

- Capital backing: T3 Trading Group provides traders with capital to trade with. This means that traders don’t need to have a large amount of their own capital to start trading. Traders can use T3 Trading Group’s capital to make trades and generate profits.

- Advanced technology: T3 Trading Group provides traders with advanced trading technology that is designed to help traders make better trades. The firm offers access to multiple trading platforms, including Sterling Trader, RealTick, and Laser, as well as a proprietary trading platform.

- Supportive community: T3 Trading Group has a supportive community of traders who work together to share ideas and strategies. The firm offers a mentorship program for new traders, which provides them with guidance and support as they learn to trade.

- Competitive payouts: T3 Trading Group offers competitive payouts to traders who generate profits. The firm uses a tiered payout structure, which means that traders who generate higher profits receive a higher percentage of their profits.

Strengths and Weaknesses of T3 Trading Group

Strengths:

- Large and established firm: T3 Trading Group is one of the largest and most established prop firms in the world. The firm has a strong reputation in the industry and has been in business for over a decade.

- Capital backing: T3 Trading Group provides traders with capital to trade with. This means that traders don’t need to have a large amount of their own capital to start trading.

- Advanced technology: T3 Trading Group offers traders access to advanced trading technology, including multiple trading platforms and a proprietary trading platform.

Weaknesses:

- Limited trading opportunities: T3 Trading Group focuses primarily on equity trading. Traders who are interested in trading other assets, such as forex or commodities, may need to look elsewhere.

- High fees: T3 Trading Group charges traders high fees for access to its technology and trading capital. Traders who generate profits may also be subject to high payout fees.

T3 Trading Group Review

Overall, T3 Trading Group is a reputable and established prop trading firm that offers traders a number of benefits, including access to capital, advanced technology, and a supportive community. However, traders should be aware of the firm’s limitations, such as its focus on equity trading and high fees.

Funding Process at T3 Trading Group

T3 Trading Group’s funding process is straightforward. Traders who wish to trade with the firm’s capital must first pass a qualification process, which includes a series of tests and evaluations. Once a trader is qualified, they can begin trading with the firm’s capital. Traders are required to maintain a minimum level of profitability in order to continue trading with the firm’s capital.

Comparison of Top Forex Prop Firms.

Overview Forex prop firms offer traders the opportunity to access funding, proprietary trading platforms, and advanced trading technology to improve their trading performance. In this comparison, we will look at some of the top Forex prop firms and analyze their features, benefits, and weaknesses.

Features, Benefits, and Weaknesses

- The5%ers: Features: Provides traders with a funded account, proprietary trading platform, and risk management system. Benefits: Offers a low-cost evaluation program and a high profit split. Traders can keep up to 90% of the profits they generate. Weaknesses: Limited educational resources and lack of transparency in the funding process.

- FTMO: Features: Offers traders a funded account, a proprietary trading platform, and risk management system. Benefits: High-profit split and low-cost evaluation program. Traders can keep up to 70% of the profits they generate. Weaknesses: Funding process can be strict and requires passing multiple stages. Limited educational resources.

- City Traders Imperium: Features: Offers traders a funded account, proprietary trading platform, and risk management system. Benefits: Traders can keep up to 80% of the profits they generate. Offers flexible funding options. Weaknesses: Limited educational resources and high monthly subscription fees.

- AudaCity Capital: Features: Provides traders with a funded account, proprietary trading platform, and risk management system. Benefits: Offers a low-cost evaluation program and a high-profit split. Traders can keep up to 90% of the profits they generate. Weaknesses: Limited educational resources and strict risk management policies.

- Maverick Trading: Features: Offers traders a funded account, proprietary trading platform, and risk management system. Benefits: Traders can keep up to 80% of the profits they generate. Offers extensive educational resources. Weaknesses: High performance expectations and strict risk management policies.

- T3 Trading Group: Features: Provides traders with a funded account, proprietary trading platform, and risk management system. Benefits: Offers traders a high-profit split and extensive educational resources. Weaknesses: Funding process can be strict and requires passing multiple stages. High subscription fees.

- SMB Capital: Features: Offers traders a funded account, proprietary trading platform, and risk management system. Benefits: Offers a low-cost evaluation program and extensive educational resources. Weaknesses: Traders can keep up to 50% of the profits they generate. High monthly subscription fees.

- Bright Trading: Features: Provides traders with a funded account, proprietary trading platform, and risk management system. Benefits: Offers flexible funding options and extensive educational resources. Weaknesses: Traders can keep up to 60% of the profits they generate. High monthly subscription fees.

Overall, the top Forex prop firms offer similar features and benefits, such as a funded account, proprietary trading platform, and risk management system. However, each firm has its own strengths and weaknesses, such as the cost of its evaluation program, profit split, and educational resources. Traders should carefully consider these factors when choosing a Forex prop firm that best suits their needs.

In conclusion, Top Forex Prop Firms

Forex prop firms offer aspiring traders an opportunity to kickstart their careers in the forex market. However, choosing the right prop firm can be challenging. The firms mentioned above have a proven track record and offer traders a chance to trade with their capital. With the right skills and mindset, you can succeed in trading and build a successful career in the forex market.

Related Articles:

Important Things To Consider Joining A Forex Prop

The Pros And Cons Of Forex Prop Trading

Best Prop Firm To Get A Funded Account

10 Forex Trading Strategies: Best For Beginners

Most Popular General Facts Of Forex Trading

How To Become A Successful Forex Trader

What Are Ways To Learn Forex Trading?

The Dark Secret Of Forex Trading

Best Ways To Make Money With Forex Website

How To Get Money To Start Forex Trading

Tips To Pass The FTMO Challenge

Forex Trading Strategy: Best Tips To Make Own

Amazing Guide On Four Types Of Traders In Forex

All About The Forex Trader Sentiment Analysis COT

Fundamental Analysis Resources To Learn Trading

Best And Complete Learn Forex Trading For Beginners

Quickest Tips To Build Own Forex Trading Strategy

What Should Learn to Start Forex Trading?

Is Swing Trading Worth It? Info And Strategy

Does Technical Analysis Really Work On Forex

Best Forex Economic News Trading Strategy

Best Tips On How To Choose A Forex Broker

How To Analyse The Euro Vs US Dollar

Way To Open Live Forex Account ECN Broker

How To Schedule A Trade On Forex